May 2019

Viemed is a rental provider of equipment such as ventilators, respiratory assistance devices (RAD), and continuous positive airway pressure devices (CPAP) that are used to treat respiratory ailments, with a focus on chronic obstructive pulmonary disease (COPD) and sleep apnea. The company generates almost all of its revenues from renting out these ventilators, thus creating a recurring revenue stream that has grown +30-40% p.a. in sales since becoming an independent company on December 22nd, 2017.

Rise of Non - Invasive Vent Technology

As 80 million American “Baby Boomers” reach 65-years old, it is no secret that the shifting United States demographics will put tremendous financial strain on the healthcare system. One of the ways to alleviate the costs of expensive in-hospital treatment is to treat chronic illnesses at home – which is where Viemed comes in.

Viemed is in the business of renting out ventilators to late-stage (typically Stage 4) COPD patients. It uses non-invasive vents (NIVs) to manage these chronic conditions, which have better outcomes as proven by lower readmission rates into hospitals – in fact, results of a July 2015 study showed a 97% reduction in readmission rates in COPD patients in the subsequent year. Out of the potential 1 million patient-potential market, there is only an installed base of 50,000 NIVs, which implies significant room of increased market penetration.

But if NIV treatment is more cost efficient and more effective, then why is the penetration just 5%? As it turns out, NIV is actually a fairly new machine that was first launched by Philips in 2012 (Philips is also Viemed’s main supplier). Until recently, there was no substitute for Stage 4 patients aside from the expensive procedure of an invasive tracheotomy.

It logically follows that, Viemed will benefit significantly from this uptake in NIV penetration. Since its first Q3 2017 filing (note again that Viemed only went public at the end of 2017), the growth has been almost +45% year-over-year for every quarter, with most of it coming from volumes.

High-Touch Industry Model with Strong Economics

Because the technology is still relatively nascent, the industry landscape is quite sparse. Currently, there are three main patents – Lincare, Apria Healthcare, and Viemed (at #3) – who together control 50% of the market, with the other 50% comprised of numerous small regional players. There are several things to note here:

- Lincare was bought by Germanbased Linde Group in 2012 for $4,6B

- Apria Healthcare was bought by Blackstone Group in 2008 for $1,7B

With the backing of such large parent companies, competition is certainly a risk. However, it is important to note that Viemed operates in a high-touch, high-service industry. Unlike most medical device companies, Viemed could not simply drop off a ventilator like a wheelchair at a house – it is an expensive patient model that depends very much of scale because each area is serviced by a respiratory therapist. The therapist builds the relationships with pulmonologists, comes to the home, starts with education of NIVs, brings in a sample for a loan, and then stays for several days during the transition. The model needs quick response times within their regions, which gives Viemed an advantage in the specific markets that they service. Lincare and Apria aren’t nimble enough to be competitive in Viemed-serviced regions.

With such a high-touch model, it comes as no surprise that Viemed, while saving money for the overall healthcare system by reducing hospital readmissions and procedures, is an expensive patient model and operates with a higher cost per person due to the servicing component. It is for this reason that Viemed gets relatively more reimbursement for the product. This has contributed to Viemed’s strong gross margins of 75%. Additionally, Viemed benefits from the fact that:

- Retention rate is effectively 100% for the life of the patient (which ranges from 6 months to three years for severe COPD).

- In just 14months in the field, Viemed makes back the money of the ventilator; meanwhile, the ventilator has a depreciation life of 10 years with minimal maintenance CapEx.

- Viemed continues to own the machine after the patient passes away, and can then pick it up, clean it, fix it, and have it redeployed to a new patient.

This has all contributed to Viemed’s high return on capital of 20%+, which – combined with its high growth rate going forward – makes it an excellent compounder.

Management

It might be helpful to provide a quick corporate history to Viemed before speaking about the management.

Viemed (previously known as Sleep Management LLC) was founded in 2006 by Casey Hoyt and Michael Moore, who grew the business from zero to almost $70 million in revenues. It was bought by Patient Health Monitoring (“PHM”), an over-levered Canadian healthcare conglomerate. The prior PHM management team were poor capital allocators and executors, and thus Hoyt was brought on not only to run Viemed, but to become CEO of PHM. However, Hoyt preferred to run the business that he had initially started, and thus Viemed was spun out in December 2017.

Today, management holds 11% of the company shares, with CEO Hoyt and President Moore each holding CAD$12m worth of stock. Lacuna has met Hoyt in one-on-one conversations and larger institutional conferences – it is clear that he is highly driven and incentivized to nurture the business that he founded. As such, we take confidence in being aligned with Viemed’s strong management team.

Summary

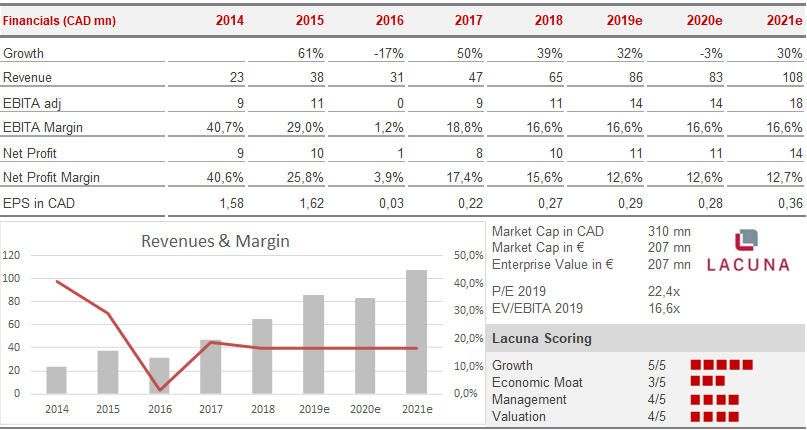

As a compounder that has only scratched the very surface of a tremendous market opportunity (and future growth prospects of +25-30% per annum), Viemed and its sticky business seems very fair priced for us.

Having two highly incentivized founders as managers and shareholders in the company, we believe that the company will grow organically and will go on in doing a great job as capital allocators.

While it is important to note that Medicare reimbursement risk cuts and competitive bidding, the soundness of the business model in the long-term would remain intact.